Roles and Responsibilities in an OCIO Relationship

An Outsourced Chief Investment Officer (OCIO) helps shoulder the full panoply of fiduciary responsibilities. From designing and implementing investment policies to providing a full range of back-office support, an OCIO relieves you of the myriad day-to-day tasks of investment management so that you can focus on your mission and strategic objectives.

Engaging an OCIO to implement the investment program expands the resources available to the Investment Committee and staff to fulfill their important fiduciary responsibilities.

Investment Committee members often ask us, “How will the role of the Investment Committee change when we hire an outsourced CIO to act as our co-fiduciary?” Our response is straightforward: “The committee’s primary role is unchanged. The committee continues to map the strategic direction of investments, provide critical oversight, and ensure that the long-term interests of the institution are served. Indeed, it is our experience that the committee’s ability to perform its essential role is enhanced by extricating itself from second-order tasks and refocusing its energies on strategy, policy setting, and oversight.”

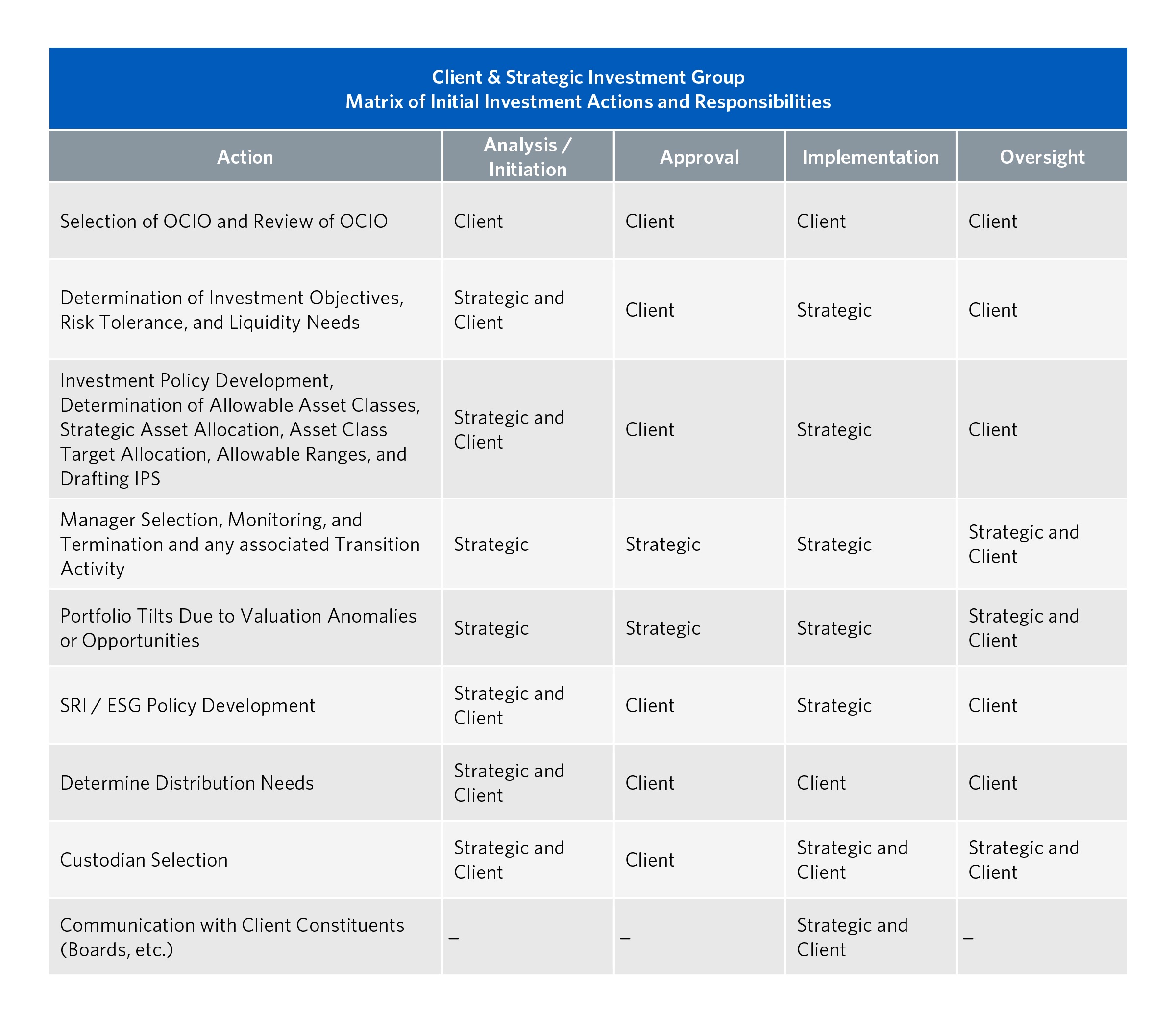

The main role of an Investment Committee is to set the strategic policy direction for investments, select agents to implement that policy on its behalf, and ensure that the agents selected adhere to agreed guidelines and targets. This essential role remains unchanged whether or not an OCIO is selected as a co-fiduciary.

Our Fiduciary Insights edition titled, “What is the Role of the Investment Committee When Hiring an OCIO?”, sets out the rationale for our response and describes how the OCIO fits in the overall investment governance structure established by the Committee, highlighting what changes and what remains constant.