Investment Process

We are risk-aware, price-sensitive investors. We believe that asset prices are ultimately determined by the fundamental factors of valuation and risk. We believe that there is value to be gained through active management, and have learned to identify relatively uncorrelated sources of value added.

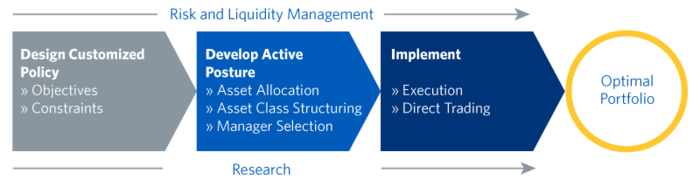

Design. Develop. Implement.

Our investment process comprises three key steps: design the investment policy, develop the portfolio structure, and implement the agreed policy.

Design

Our client-centric process focuses on designing an optimal long-term strategy that is customized to each client’s unique objectives, risk appetite, and mission. We collaborate with our client to set an investment policy that defines financial objectives and risk parameters and provides the framework—including asset allocation guidelines, benchmarks, and risk control ranges—for achieving those goals.

Develop

Once the investment policy is set, Strategic develops the active portfolio structure relative to that policy. Our tactical asset allocation decisions integrate proprietary and third party insights to assess the relative attractiveness of asset classes. Using these insights, we actively manage asset allocations in light of changing economic conditions and relative valuations. Our structuring tilts within asset classes seek to exploit valuation anomalies across different market segments. We use proprietary analytical tools to disentangle the underlying factor exposures of each asset class, assess their relative valuations, and actively manage the exposure to each factor.

Implement

We are portfolio managers, not just manager selectors. We strive to construct optimal portfolios of diversified market and active exposures. Our proprietary analytics and seasoned team bring experienced insight to structuring portfolios and selecting and monitoring what we believe to be top-tier managers. We use active managers to seek alpha and help achieve the targeted portfolio structure. Our direct trading capacity—using Treasuries, futures, TIPS, and ETFs—complements active managers and enhances liquidity, lowers costs, and increases agility.

Manage Risk and Liquidity

Our comprehensive, proprietary risk management system evaluates and seeks to calibrate the macro-level risks that arise from asset allocation and structuring decisions as well as the security-specific risks produced by the active management activities of specialist investment managers. These sophisticated analytics disentangle the underlying risk factors embedded in a portfolio. Our analytics allow us to manage the exposure to each risk factor as a means of managing absolute and relative risk.